Hotel reward programs work the same way airline frequent flyer programs do. Hotel guests are given points for every dollar they spend on stays at the hotel. Loyalty program members also receive special perks that can include late check-in/check out, room upgrades and other perks during their stay.

Co-Branded Credit Cards

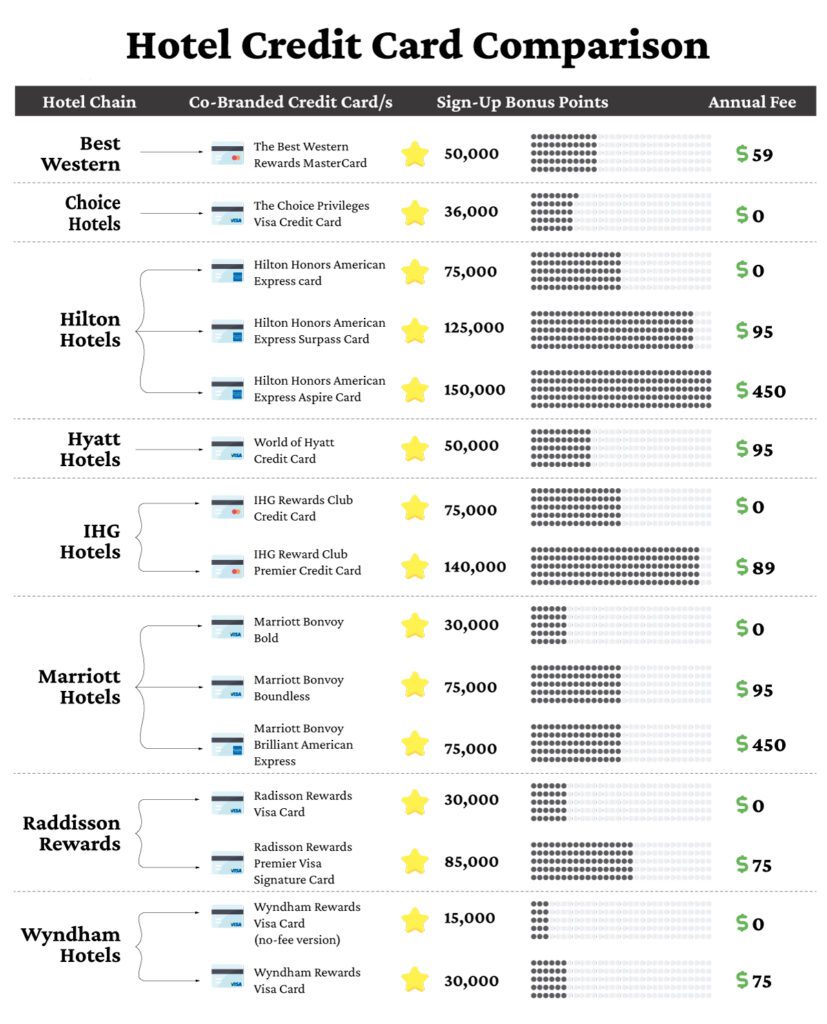

One thing many people don’t realize though is that you can earn free nights at a hotel without ever booking a stay. This is possible because most hotel chains offer co-branded credit cards that come with big sign-up bonuses and allow you to earn reward points for every dollar you spend using the credit card.

You should be aware that the cards generally carry a fee, but that is sometimes waived the first year and some have no fee. Also, sign-up bonuses require you to spend a certain amount of money in the first 90 days to earn the sigh-up bonus.

But the cost of the card is usually easily justified with the value of the points you earn on the sign-up bonus alone, and some offer a free anniversary night or bonus points to boost value for people who keep the card beyond the first year. And the perks that come with holding the card are also valuable, especially for frequent travelers.

How Hotel Programs Work

You can use the hotel reward points earned to pay for a night or even a week or more at a hotel, depending on how many points you’ve accumulated and how much the hotel you want to stay in costs in points per night. Redemptions range from 10,000 or even less per night for budget hotels to 50,000 or more for resort stays.

Every program is different though so be sure to do your research through the hotel booking site about the number of points needed to stay per night as that number varies from one chain to another, and from one property to the next within each chain. The dates of travel can also affect rates, as peak travel times will generally cost more.

The good news with hotel programs is there are no blackout dates. Unlike airlines that allocate a select number of seats on each flight to their frequent flyer programs, hotel frequent stay programs do not have blackout dates so if there is room available at the hotel, you can usually book it with your points.

We’ll take a look at the major hotel chains and the co-branded cards they offer so you can get an idea how it all works.

Best Western Rewards

The Best Western Rewards MasterCard from First Bankcard comes with automatic Platinum Rewards elite status in the hotel’s reward program. You can earn 50,000 points after you spend $1,000 in the first three billing cycles, and another 20,000 bonus points when you spend at least $5,000 every 12 months. You earn 20 points per dollar on Best Western stays charged on the card and one point per dollar on other purchases. Hotel nights cost from 8,000 to 36,000 per night, or an average of 16,000 points. The card costs $59 a year.

Choice Privileges Rewards

The Choice Privileges Visa Signature card from Barclays comes with Elite Gold status, which gives you a 10% point bonus on stays. You earn 32,000 points after you spend $1,000 in the first 90 days. You’ll also earn 8,000 points on your anniversary if you spend $10,000 or more in purchases the first year. You earn 15 points per dollar spent on hotel stays and two points on all other purchases. The best part about this card is it has no annual fee.

Hilton Honors

Learn – All About The Hilton Honors Program

Hilton offers three different credit cards. The Hilton Honors American Express card offers Silver status, 75,000 bonus points when you spend $1,000 in the first three months after approval and comes with no annual fee. The Hilton Honors American Express Surpass card carries an annual fee of $95, but comes with Gold status and 125,000 points after spending $2,000 in the first three months, and the premium Hilton Honors American Express Aspire card comes with Diamond status and earns 150,000 points after spending $4,000 in the first three months. You also get a $250 statement credit for a stay at a Hilton resort. All three cards offer bonus points on hotels stays, groceries, dining and/or gas purchases, and the two with an annual fee offer a free weekend night when you renew the card each year. See card links for more details.

World of Hyatt

The World of Hyatt credit card from Chase has a tiered sign-up bonus. That means that you can earn 25,000 points after spending $3,000 in the first three months of having the card, and another 25,000 points if you spend $6,000 in total in the first six months. That 50,000 points is worth 10 free nights in a Category 1 hotel. You’ll also get seven points per dollar spent at hotels in the Hyatt chain, double points on other categories including travel, dining and gym memberships, and one point per dollar for other purchases. The card costs $95 a year.

IHG Reward Club

IHG, which includes the Crowne Plaza, Holiday Inn and InterContinental brands, offers two different cards through Chase. The Premier version 140,000 points for spending $3,000 in the first three months, and has an annual fee of $89. You’ll earn 15x points for every dollar spent at IHG hotels with the free version, and 25x points for the Premier. The cards also earn double points on purchases at gas stations, supermarkets and restaurants, and one point on everything else. The upgraded version also offers Platinum status, a free night when you redeem rewards for stays of four nights or more, and a free night on your anniversary.

Read our in depth article – Everything You Want To Know About Marriott Bonvoy

Marriott, which also includes the former Starwood Hotels, offers three personal credit cards through two different issuers. The Marriott Bonvoy Bold from Chase has no fee and will give you 30,000 sign-up bonus points after you spend $1,000 in the first three months. It also offers 3x points at Marriotts, 2x on travel and 1x on everything else. The Marriott Bonvoy Boundless, also from Chase, has a 75,000 point welcome bonus, 6x on Marriott stays and 2x on everything else. The Marriott Bonvoy Brilliant American Express card is a premium card that comes with Gold status in the hotel program and charges a $450 annual fee, but also has a $300 travel credit, Priority Pass lounge access and a Global Entry or TSA PreCheck credit to offset the cost. It comes with 75,000 bonus points after spending $3,000 in the first three months. You earn 6x points at Marriott hotels, 3x on dining and airline flights booked direct with the airline, and 2x on everything else. You also get a free night award on your anniversary, which is worth up to 50,000 points.

Radisson Rewards

Radisson offers a no-fee card and one for $75 a year though US Bank. The Radisson Rewards Visa card has no fee and comes with 30,000 points after you spend $1,000 on the card in the first 90 days. You get three points for stays at Radisson hotels and one point for everything else. The Radisson Rewards Premier Visa Signature card comes with Gold status in the reward program and up to 85,000 bonus points. You’ll receive 50,000 points after your first purchase and another 35,000 after you spend $2,500 in the first 90 days. You earn 10x points on Radisson stays and 5x on all other purchases, and 40,000 points when you renew the card after your first year. You can also earn up to three free nights every year with either card, one night for every $10,000 you spend.

Wyndham Rewards

Wyndham also offers a card with no fee and one with an annual fee. The Wyndham Rewards Visa Card from Barclays with no annual fee offers 15,000 points after your first purchase. That’s enough points for two free nights. You get Gold status and earn three points spent at Wyndham hotels, two points on gas, groceries and utilities, and one point on everything else. The other card charges a $75 annual fee and comes with a welcome offer of 30,000 points, good for four nights. Half of that is earned with your first purchase, and the other 15,000 is earned after spending $1,000 in the first 90 days of account opening. This one comes with Platinum status and lets you earn 5x on Wyndham stays and the same bonus categories as the no-fee card. You’ll also get 6,000 points on your anniversary.

Transferable Points Programs

There are also credit cards that have rewards that can be transferred to hotels. American Express has several cards in its portfolio that earn Membership Rewards points and they can be transferred to Hitlon or Marriott. And Chase Ultimate Rewards, which are earned on several popular Chase credit cards including the Sapphire Preferred and Reserve, transfer to Hyatt, IHG and Marriott.

The important thing to keep in mind if you want to transfer these points to your hotel program is to make sure you are getting the best value for your points. Since you can trade Chase Ultimate Rewards in for cash at a cost of one penny per point, you should make sure you are getting at least that much value if you transfer for a free hotel night stay.

Also, transferable points can be used to buy travel through a dedicated travel portal or they can be transferred to airline frequent flyer programs, so be sure to check on these other options for your travel needs to see if you can reap more value from the points before you move them to your hotel account. This reward program currency is useful to top off your account if your points stash is shy of the amount you need for your desired stay.

Other Travel Credit Cards

There are also other cards like Capital One Venture and Barclaycard that also have sign-up bonuses, and these cards earn 2x points on all your spend. These cards don’t transfer to the hotel reward program for redemption. You purchase your hotel stay, and then get a credit for the purchase using points at a penny per point redemption.

These cards are best for people who don’t want their free vacation goals tied to a particular hotel program as they allow you to “erase” the charge as long as it is coded as travel. They are also good for beginners that are new to travel rewards programs.

Conclusion

So as you can see if you play your cards right — credit cards that is — you can increase your chances for a free hotel night stay. You just need to figure out where you want to stay, create a strategy and accrue rewards points in the hotel’s program though stays or credit card sign-up bonuses and spending.

Once you’ve decided on a destination and property that you’re interested in, enroll in the hotel’s loyalty program if you’re not already a member and start earning points towards your stay. If you want to figure out how many points you might need, go to the hotel chain’s booking site, select dates you would like to travel, and choose the “points” option for payment to determine the number of points needed per night.

If you’re new to rewards programs and know which chain you want to stay in, the best bet is to apply for that hotel’s co-branded card, be sure to meet the minimum spend to earn the sign-up bonus, and charge things that you would normally buy on that card to keep adding to your balance until you reach your goal.